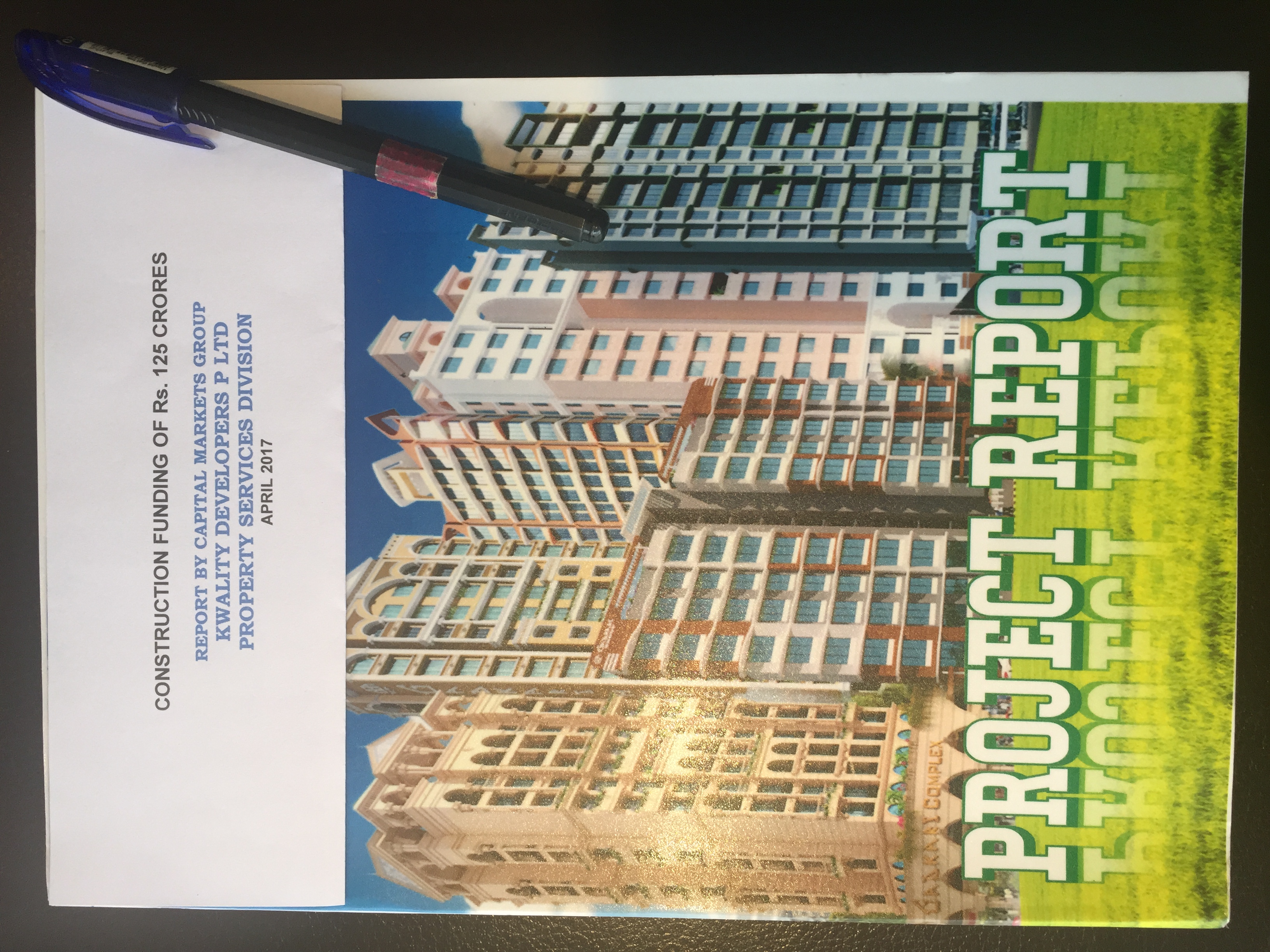

Our senior team of Capital Markets executives have prior experience in the banking, NBFC, real-estate development and IPC industries. We have built relationships with banks, NBFCs, private equity funds and high-net investors that are currently looking to deploy capital. In turn, we ensure our clients a confidential and time-bound process to raise capital for any real-estate requirement. Our services include:

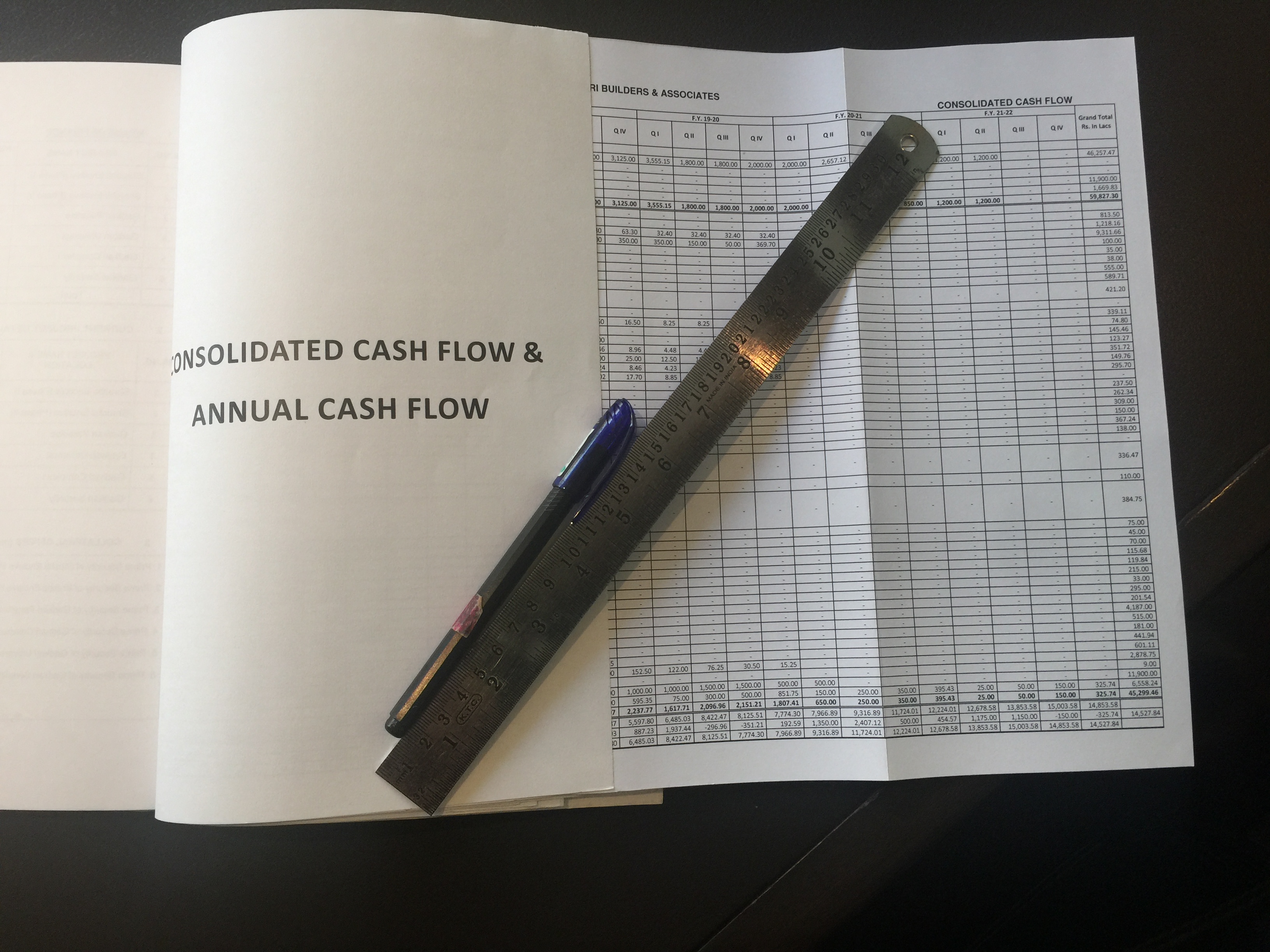

- Capital for Real-estate Developers: We provide builders with the comfort of running a speedy process for raising capital for their working capital needs or balance-sheet financing. Our team understands the specific nature of each situation, and caters to customized solutions suited to each client: from private equity, mezzanine financing, construction finance, discounting of rental income and several others.

- Capital for Purchasing Real-Estate: For Corporates or HNIs looking to purchase real estate assets, we provide advisory on the most optimal route to raise capital. In addition, we run a process to acquire the financing right from documentation to payout to successful asset conveyance.

- Capital through Sale of Assets: Together with our Transactions Team, we advise on and carry-out the industry-leading process-driven mandate for selling of real-estate assets. Depending on the each case, we offer private and public bidding, auctions, direct sales, and advertising and promotions.

- Special Situations: Occasionally, our team will leverage our special relationships with market participants to raise and/or deploy capital at mutually beneficial terms for borrowers and lenders. We work on an intermediary basis, ensuring full transparency to all parties involved.